Anne-Charlotte Vaissière and Harol Levrel have published a new paper entitled “Biodiversity offset markets: What are they really? An empirical approach to wetland mitigation banking” in Ecological Economics (Volume 110, February 2015, Pages 81–88). Read more on the Journal website (pay-walled). For more information see also a related discussion on LinkedIn (in the Biodiversity Professionals Group, you need to become member of the group to join the discussion) and the authors’ conclusions below.

Anne-Charlotte Vaissière and Harol Levrel have published a new paper entitled “Biodiversity offset markets: What are they really? An empirical approach to wetland mitigation banking” in Ecological Economics (Volume 110, February 2015, Pages 81–88). Read more on the Journal website (pay-walled). For more information see also a related discussion on LinkedIn (in the Biodiversity Professionals Group, you need to become member of the group to join the discussion) and the authors’ conclusions below.

Conclusions

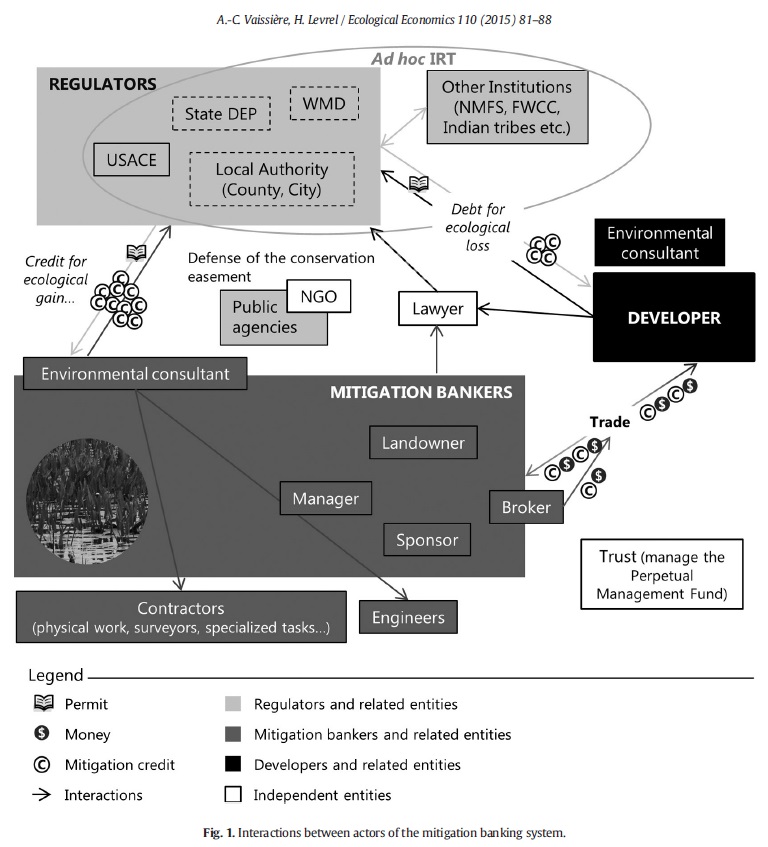

The goal of this paper was to investigate the “market” nature of wetland mitigation banking. By studying a total of 16 criteria from three complementary approaches, the paper shows that the mitigation banking system is akin in some respects to a market but that it is actually a hybrid form halfway between market and hierarchy. The market characteristics of the mitigation banking system allow a certain degree of autonomy and self-adjustment between developers and mitigation bankers, once the number of allocated or required credits has been determined by regulators. Issues of biodiversity conservation have led the regulators responsible for the implementation of the wetland mitigation banking system to take into account the complexity and geographic specificity of aquatic ecosystems. This means that there are multiple markets for wetland offsets, both geographically (service areas) and in the types of traded goods (credits). Thus, we conclude that the mitigation banking system cannot be compared with a global market such as carbon.

Oversimplifying the nature of the mitigation banking system as a “market” has led to excessive criticism of this biodiversity offset. For instance, Walker et al. (2009) criticizes markets dedicated to nature as commodification devices, while Robertson (2004) describes mitigation banking as a risky neoliberal approach to environmental governance.

However, these two papers do not provide empirical evidence for these claims. More recent papers have given some empirical details to clarify the risks of this system (BenDor et al., 2011; Robertson and Hayden, 2008; Robertson, 2009). The present paper should help to identify theopportunities and the risks of the mitigation banking system using recognized theoretical frameworks, such as the features of hybrid forms as given by the new institutional economics framework.

Pingback: (First) Biodiversity Offsets NewsMONTH, January 2015 - Biodiversity Offsets Blog